Managing your personal finances can feel like running a business. That’s why adopting a CFO approach to personal budgeting has become increasingly popular. By treating your own finances like a corporation, you can gain better control over your money and make more informed financial decisions.

In this article, we will explore the benefits of using the CFO approach to personal budgeting and learn how to apply it in your own life. Whether you’re a seasoned entrepreneur or simply looking to improve your financial well-being, this guide will provide you with the tools and strategies to manage your money with confidence.

Using insights from the world of corporate finance, we will discuss essential concepts such as cash flow management, cost control, and strategic planning. We’ll also uncover ways to optimize your savings, minimize debt, and set realistic goals to achieve your financial objectives.

So, if you’re ready to take charge of your personal finances and achieve financial success, join us as we dive into the CFO approach to personal budgeting.

Understanding the CFO Approach to Personal Budgeting

The CFO approach to personal budgeting is all about applying the financial management techniques used in corporations to individual finances. At its core, this method emphasizes strategic planning, disciplined spending, and proactive decision-making. Just as a Chief Financial Officer (CFO) of a corporation analyzes data, forecasts future trends, and allocates resources effectively, you can use similar principles to manage your personal finances.

One of the fundamental aspects of this approach is the realization that every financial decision you make impacts your overall financial health. By adopting a corporate mindset, you become more aware of your cash inflows and outflows, allowing you to make better decisions regarding your spending and saving habits. This perspective encourages you to think critically about your financial choices, enabling you to prioritize essential expenses while minimizing unnecessary costs.

Furthermore, the CFO approach emphasizes the importance of financial reports. Just as businesses rely on balance sheets and income statements to evaluate their financial performance, individuals can benefit from tracking their income, expenses, and savings. By regularly reviewing these financial statements, you can identify trends, assess your financial health, and make informed decisions that align with your long-term goals.

Applying Corporate Financial Principles to Personal Finances

Applying corporate financial principles to personal finances can provide a structured and disciplined approach to managing your money. By adopting strategies used by successful businesses—such as cash flow management, cost control, and strategic planning—you can achieve greater financial stability and work toward your long-term goals with confidence.

1. Cash Flow Management: The Foundation of Financial Health

In the corporate world, cash flow management is critical for ensuring an organization’s financial stability. The same principle applies to personal finances. Cash flow refers to the money coming in (income) and going out (expenses) over a given period. Monitoring and optimizing your cash flow helps you maintain a clear picture of your financial health and make informed decisions.

How to Apply It:

- Track Income and Expenses: Start by recording all sources of income, such as salaries, freelance work, or investment returns, alongside your expenses. Categorize expenses into fixed costs (e.g., rent, utilities) and variable costs (e.g., dining out, entertainment).

- Analyze Spending Patterns: Identify areas where cash outflows are higher than necessary. For example, if you’re consistently overspending on discretionary items, adjust your budget to reallocate those funds more effectively.

- Create a Cash Flow Statement: Similar to a corporate cash flow statement, outline your monthly inflows and outflows. This practice will help you identify surpluses or deficits and ensure that your spending aligns with your income.

Benefits:

Understanding and managing your cash flow prevents overspending, ensures that you have enough funds for essentials, and creates opportunities for savings and investments.

2. Cost Control: Optimizing Your Personal Budget

Corporations prioritize cost control to maintain profitability, often reviewing operational expenses to identify inefficiencies. In personal finance, cost control is equally vital for optimizing your budget and freeing up resources for other financial priorities.

How to Apply It:

- Review Recurring Expenses: Audit your subscriptions, memberships, and recurring payments. Cancel or downgrade services that you don’t use or that don’t add significant value to your life.

- Limit Discretionary Spending: Identify areas of discretionary spending—such as dining out, entertainment, or impulse purchases—and set limits for these categories. Using budgeting apps or envelope budgeting methods can help.

- Comparison Shopping: Before making major purchases, compare prices or seek discounts to minimize costs. Even small savings on regular expenses can add up over time.

- Avoid Lifestyle Inflation: Resist the temptation to increase spending as your income grows. Instead, allocate raises or bonuses toward savings, investments, or debt repayment.

Benefits:

Cost control increases your savings rate, reduces financial stress, and provides flexibility for future opportunities, such as traveling, investing, or building an emergency fund.

3. Strategic Financial Planning: A Roadmap for Your Goals

Corporations develop multi-year financial plans to ensure sustainable growth and profitability. Similarly, strategic planning in personal finance involves setting clear goals and creating a roadmap to achieve them. This approach provides focus and direction, allowing you to align your financial decisions with your long-term objectives.

How to Apply It:

- Set SMART Goals: Establish goals that are Specific, Measurable, Achievable, Relevant, and Time-bound. Examples include:

- Saving ₱1 million for a home down payment within five years.

- Paying off credit card debt in 12 months.

- Building an emergency fund equal to six months of living expenses.

- Prioritize Goals: Rank your goals based on urgency and importance. For instance, paying off high-interest debt might take precedence over saving for a vacation.

- Break Down Goals into Actionable Steps: Divide each goal into smaller, manageable milestones. For example, if your goal is to save ₱1 million in five years, aim to save ₱200,000 per year or ₱16,666 per month.

- Regularly Review and Adjust: Just as corporations review financial plans quarterly or annually, revisit your personal financial roadmap periodically. Adjust for life changes, such as a new job, marriage, or unexpected expenses.

Benefits:

Strategic financial planning helps you stay motivated, maintain discipline, and measure progress, ensuring that your financial goals remain within reach despite changing circumstances.

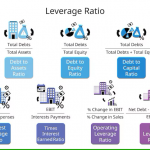

4. Borrowing and Debt Management: The Leverage Principle

In corporate finance, borrowing (leverage) is used strategically to fund growth opportunities, but excessive debt can jeopardize financial health. Applying this principle to personal finance involves using debt responsibly and ensuring that it aligns with your goals.

How to Apply It:

- Differentiate Between Good Debt and Bad Debt:

- Good Debt: Debt that helps build assets or improve earning potential, such as student loans, mortgages, or business loans.

- Bad Debt: High-interest debt used for non-essential purchases, such as credit card balances or payday loans.

- Manage Debt Strategically: Aim to pay off high-interest debt first while maintaining minimum payments on lower-interest debts. Consider consolidating debts at a lower interest rate if possible.

- Avoid Over-Leveraging: Ensure that your debt-to-income ratio (the percentage of your income used to pay debts) remains manageable, ideally under 36%. Borrow only what you can afford to repay comfortably.

Benefits:

Strategic debt management reduces financial stress, improves credit scores, and ensures that borrowing serves your long-term goals rather than becoming a financial burden.

5. Building Financial Reserves: Liquidity and Emergency Funds

Corporations maintain liquidity to cover unexpected expenses and seize opportunities. Similarly, having personal financial reserves, such as an emergency fund, provides security and flexibility.

How to Apply It:

- Build an Emergency Fund: Set aside three to six months’ worth of living expenses in a high-yield savings account for unforeseen events like job loss, medical emergencies, or home repairs.

- Maintain Accessible Cash Reserves: Ensure that at least part of your savings is in liquid assets that can be accessed quickly, rather than being locked in long-term investments.

- Balance Liquidity and Growth: While keeping cash reserves is important, don’t overallocate to savings accounts at the expense of higher-return investments. Strike a balance that aligns with your risk tolerance.

Benefits:

Liquidity ensures that you can handle unexpected challenges without derailing long-term financial plans or resorting to high-interest debt.

6. Performance Metrics: Measuring Financial Health

Corporations use metrics like profit margins, return on investment (ROI), and debt-to-equity ratios to assess their financial performance. In personal finance, similar metrics can help you evaluate your financial health.

How to Apply It:

- Savings Rate: Measure the percentage of your income saved each month. A higher rate indicates better financial discipline and progress toward goals.

- Net Worth: Calculate your net worth by subtracting liabilities from assets. Tracking this over time provides a clear picture of your financial trajectory.

- Debt-to-Income Ratio: Monitor your debt-to-income ratio to ensure that debt obligations remain manageable and do not exceed recommended thresholds.

- Return on Investments: Evaluate the performance of your investments to ensure they align with your risk tolerance and financial objectives.

Benefits:

Using performance metrics helps you stay accountable, identify areas for improvement, and make data-driven decisions to enhance your financial future.

Setting Financial Goals and Objectives

Financial goals serve as a guiding light on your path to financial success. Without clear objectives, it can be easy to get lost in the day-to-day management of your finances. Start by defining your short-term, medium-term, and long-term financial goals. Short-term goals might include building an emergency fund or paying off credit card debt, while long-term goals could involve saving for retirement or purchasing a home.

When setting your goals, it’s essential to ensure they are realistic and achievable. Use the SMART criteria to evaluate your objectives. For example, instead of saying, “I want to save money,” you might say, “I want to save $5,000 for a vacation within the next 12 months.” This specificity makes it easier to develop a plan and track your progress.

Once you’ve established your goals, prioritize them based on urgency and importance. For instance, building an emergency fund may take precedence over saving for a vacation. This prioritization will guide your budgeting decisions and ensure that you’re focusing your resources on the most significant objectives first.

Creating a Comprehensive Budget

A comprehensive budget is the backbone of effective personal finance management. It serves as a financial blueprint that outlines your income sources, expenses, savings, and financial goals. To create a budget, begin by listing all your income sources, including your salary, bonuses, side hustles, and any passive income. This total will form the foundation of your budget.

Next, categorize your expenses into fixed and variable costs. Fixed expenses are consistent and predictable, such as rent or mortgage payments, insurance, and loan payments. Variable costs, on the other hand, can fluctuate from month to month, including groceries, entertainment, and discretionary spending. By understanding how much money goes out each month, you can identify areas for potential savings and make informed financial decisions.

Once you’ve outlined your income and expenses, allocate funds to each category based on your financial goals. Ensure that your budget allows for savings, debt repayment, and discretionary spending while keeping you within your means. Review your budget regularly, making adjustments as necessary to reflect changes in your financial situation or lifestyle. A well-structured budget will empower you to take control of your finances and work towards achieving your financial objectives.

Tracking and Analyzing Personal Financial Data

Tracking and analyzing your personal financial data is a crucial component of the CFO approach. Just as a corporation evaluates its financial performance regularly, you should also keep a close eye on your financial activities. Start by maintaining a detailed record of your income and expenses, using spreadsheets or budgeting apps to simplify the process. This practice will provide you with valuable insights into your spending habits.

Analyze your financial data to identify trends and patterns. For instance, you may discover that you consistently overspend in certain categories or that your income fluctuates significantly from month to month. Understanding these trends will enable you to make informed decisions about your spending and saving strategies.

Moreover, consider conducting a monthly or quarterly financial review. During this review, assess your progress towards your financial goals, evaluate your budget’s effectiveness, and make any necessary adjustments. This proactive approach will keep you aligned with your objectives and help you adapt to changes in your financial situation, ensuring that you remain in control of your finances.

Implementing Cost-Cutting Strategies

To optimize your personal budget, implementing cost-cutting strategies is essential. Start by examining your discretionary spending. Identify areas where you can reduce expenses without sacrificing your quality of life. For example, consider dining out less frequently, canceling unused subscriptions, or finding more affordable alternatives for your regular purchases.

Another effective cost-cutting strategy is to negotiate bills and services. Many companies are willing to lower your rates if you ask. Contact your service providers for internet, cable, and insurance and inquire about promotions or discounts. This simple step can lead to significant savings over time.

Additionally, consider adopting a minimalist lifestyle. By focusing on needs rather than wants, you can reduce unnecessary expenses and declutter your life. Embracing minimalism not only helps your wallet but also promotes a sense of financial freedom and well-being.

Maximizing Income and Managing Expenses

Maximizing your income is just as important as managing your expenses in the CFO approach to personal budgeting. Explore opportunities to increase your earnings, such as asking for a raise, seeking promotions, or pursuing additional education or certifications that could enhance your skills. If feasible, consider starting a side hustle or freelance work to supplement your income.

On the expense management side, prioritize your spending. Distinguish between essential and non-essential expenses, and allocate your resources accordingly. Focus on necessities, such as housing, utilities, and groceries, while minimizing discretionary spending on non-vital items. This prioritization will ensure that your essential needs are met while allowing you to save and invest for the future.

Furthermore, automate your finances to simplify managing income and expenses. Set up automatic transfers to your savings account or investment funds, ensuring that you consistently contribute to your financial goals. Automating bill payments can also help you avoid late fees and maintain a positive credit score. By streamlining these processes, you can focus more on achieving your financial objectives.

Building an Emergency Fund and Planning for the Future

An emergency fund is a crucial component of financial stability. Just as businesses set aside reserves to handle unexpected expenses, individuals should also build a financial cushion to cover unforeseen circumstances. Aim to save three to six months’ worth of living expenses in a separate savings account dedicated to emergencies. This fund will provide peace of mind and prevent you from falling into debt when unexpected expenses arise.

In addition to an emergency fund, it’s essential to plan for your future. Consider your long-term financial goals, such as retirement, purchasing a home, or funding your children’s education. Start by researching the different savings and investment vehicles available to you. Options may include retirement accounts like 401(k)s or IRAs, as well as investment accounts for stocks, bonds, or mutual funds.

As you build your emergency fund and plan for the future, regularly review and adjust your financial plan as needed. Life circumstances can change, and your financial goals may evolve over time. By staying proactive and adaptable, you can ensure that your financial strategy remains aligned with your life goals, ultimately leading to a more secure financial future.

Investing and Diversifying Personal Finances

Investing is a critical aspect of the CFO approach to personal budgeting. While saving is essential, investing allows your money to grow over time, helping you achieve your long-term financial goals. Start by educating yourself about different investment options, such as stocks, bonds, real estate, or mutual funds. Understanding the risk and return associated with each investment type will help you make informed decisions.

Diversification is another key principle of investing. Just as corporations spread their investments across various assets to minimize risk, you should also diversify your investment portfolio. This strategy helps protect your finances from market volatility and reduces the impact of poor-performing investments on your overall portfolio. Consider allocating your assets across different sectors, industries, and geographic locations to achieve a balanced investment strategy.

Regularly review your investment portfolio to ensure it aligns with your financial goals and risk tolerance. As you progress through different life stages, your financial needs and objectives may change, requiring you to reassess your investment strategy. By staying informed and adaptable, you can maximize your investment returns while managing risk effectively.

Conclusion: Taking Control of Your Finances with the CFO Approach

In conclusion, adopting the CFO approach to personal budgeting empowers you to take control of your finances and achieve your financial goals. By applying corporate financial principles to your personal finances, you can enhance your cash flow management, implement cost-cutting strategies, and maximize your income.

Setting clear financial goals and creating a comprehensive budget will provide you with a roadmap for your financial journey. Tracking and analyzing your financial data will keep you accountable and allow you to make informed decisions. Additionally, building an emergency fund and investing wisely will help secure your financial future.

Ultimately, the CFO approach encourages a proactive and strategic mindset toward personal finance management. By viewing your financial life through the lens of a CFO, you can navigate the complexities of personal budgeting with confidence and clarity. Take charge of your finances today, and watch as you move closer to achieving your financial objectives.