In the ever-evolving world of entrepreneurship, the term “unicorn” has become synonymous with success, innovation, and the promise of astronomical returns. These startups, valued at $1 billion or more, have captured the imagination of investors, entrepreneurs, and the general public alike. The allure of these billion-dollar companies is undeniable, fueled by the stories of overnight successes and the potential to transform entire industries.

However, as with any hype, it’s essential to look beyond the surface and examine the true value of these unicorn startups. While some may indeed possess the necessary ingredients for long-term success, others may be riding the wave of inflated valuations and investor enthusiasm. It’s crucial for both investors and entrepreneurs to approach these unicorns with a critical eye, understanding the factors that contribute to their worth and the potential risks associated with investing in them.

In this article, we will delve into the world of unicorn startups, exploring the key factors that determine their true value. From evaluating their business models and market potential to analyzing their financial health and leadership, we will uncover the truth behind the hype and empower readers to make informed decisions when it comes to investing in or building their own unicorn startups.

Key factors to consider when assessing the value of a unicorn startup

When it comes to evaluating the true value of a unicorn startup, there are several critical factors to consider. These factors go beyond the simple valuation number and delve deeper into the underlying drivers of the business.

First and foremost, it’s essential to understand the startup’s business model and revenue streams. A unicorn’s valuation is often based on its potential for growth and scalability, but a closer examination of its revenue sources, cost structure, and profitability can reveal the true sustainability of the business. Are the revenue streams diversified, or is the startup heavily reliant on a single product or service? Are the costs under control, or is the company burning through cash at an unsustainable rate? These are the kinds of questions that must be answered to gauge the startup’s financial viability.

Another crucial factor to consider is the startup’s market potential and competitive landscape. Is the market large enough to support the unicorn’s growth ambitions? Is the startup’s product or service truly differentiated, or is it facing intense competition from established players or other emerging startups? Understanding the market dynamics and the startup’s position within it can provide valuable insights into its long-term growth prospects.

Additionally, the leadership team and the company’s culture play a significant role in determining the unicorn’s value. A strong, experienced management team with a proven track record of success can instill confidence in investors, while a dysfunctional or inexperienced team can be a red flag. Similarly, a positive and collaborative company culture can foster innovation, employee retention, and customer loyalty, all of which contribute to the startup’s long-term success.

Evaluating the business model of a unicorn startup

At the heart of any unicorn startup’s value lies its business model. This encompasses the way the company generates revenue, the cost structure, and the overall sustainability of the enterprise. A thorough evaluation of the business model is crucial in determining the true worth of a unicorn startup.

One of the key aspects to consider is the diversity and scalability of the startup’s revenue streams. Unicorns that rely heavily on a single product or service may be more vulnerable to market fluctuations or competition, whereas startups with multiple revenue sources and the ability to scale their offerings are more likely to withstand the ups and downs of the market. A diversified revenue model not only provides stability but also signals the startup’s adaptability and long-term viability.

Another important factor to examine is the startup’s cost structure and profitability. While many unicorns may have impressive top-line growth, it’s essential to delve into the underlying financials to understand the company’s ability to generate sustainable profits. Are the costs under control, or is the startup burning through cash at an unsustainable rate? Are there opportunities for operational efficiencies or cost-cutting measures that could improve the bottom line? These insights can provide a clearer picture of the startup’s financial health and its potential for long-term profitability.

Additionally, it’s crucial to assess the scalability of the business model. Can the startup’s products or services be easily replicated and expanded into new markets, or is the growth limited by inherent constraints? The ability to scale efficiently and cost-effectively is a key driver of a unicorn’s valuation, as it directly impacts the company’s potential for future growth and market dominance.

Analyzing the market potential and competition of a unicorn startup

Alongside the evaluation of a unicorn startup’s business model, it’s essential to assess the broader market landscape and competitive environment in which the company operates. The size and growth potential of the target market, as well as the level of competition, can have a significant impact on the startup’s long-term viability and value.

When analyzing the market potential, it’s crucial to consider the size of the addressable market, the rate of growth, and the startup’s ability to capture a meaningful share of that market. A large and rapidly growing market presents greater opportunities for the unicorn to scale and dominate, whereas a smaller or stagnant market may limit the startup’s long-term potential. Additionally, understanding the target demographic, their pain points, and the potential for market expansion can provide valuable insights into the startup’s ability to sustain and grow its customer base.

Equally important is the assessment of the competitive landscape. Unicorn startups often disrupt established industries, but they must be able to maintain their competitive edge in the face of fierce competition. Evaluating the strengths and weaknesses of the startup’s competitors, their market share, and their ability to respond to the unicorn’s offerings can shed light on the startup’s long-term competitive advantage. Are there significant barriers to entry that protect the unicorn’s position, or is the market highly saturated and susceptible to price wars and commoditization?

Furthermore, it’s crucial to consider the potential for new entrants and technological advancements that could disrupt the market. Unicorns must be able to adapt and innovate to stay ahead of the curve, as complacency can quickly lead to a loss of market share and a decline in valuation. Staying attuned to industry trends, regulatory changes, and emerging technologies can help investors and entrepreneurs assess the long-term viability of a unicorn startup.

Assessing the financial health and growth trajectory of a unicorn startup

While the hype and excitement surrounding unicorn startups often focus on their sky-high valuations, a comprehensive assessment of their financial health and growth trajectory is essential in determining their true worth. A closer examination of the startup’s financial statements, cash flow, and growth metrics can reveal the underlying drivers of its valuation and the sustainability of its business model.

One of the key financial metrics to consider is the startup’s revenue growth. Unicorns are often valued based on their potential for rapid and sustained revenue expansion, but it’s crucial to analyze the quality and sources of this growth. Are the revenue streams diversified, or is the startup heavily reliant on a single product or service? Is the growth driven by organic demand or by aggressive marketing and discounting strategies that may not be sustainable in the long run?

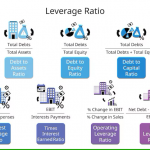

Additionally, it’s important to examine the startup’s profitability and cash flow. While many unicorns may prioritize growth over immediate profitability, a closer look at their operating margins, net income, and free cash flow can provide valuable insights into the financial viability of the business. Are the costs under control, or is the startup burning through cash at an unsustainable rate? Can the startup generate positive cash flow to fund its operations and future growth, or is it reliant on constant fundraising to stay afloat?

Furthermore, the startup’s growth trajectory and its ability to scale efficiently are critical factors in assessing its long-term value. Unicorns are often valued based on their potential for exponential growth, but it’s essential to understand the drivers of this growth and the startup’s ability to maintain it over time. Are there clear pathways for the startup to expand into new markets, introduce new products, or increase customer lifetime value? Can the company leverage its existing infrastructure and resources to scale efficiently, or will it require significant additional investment to sustain its growth?

Examining the leadership and team behind a unicorn startup

In the world of unicorn startups, the quality and experience of the leadership team can be a make-or-break factor in determining the long-term value of the company. A strong, visionary, and cohesive management team can be the driving force behind a unicorn’s success, while a dysfunctional or inexperienced team can be a significant liability.

When evaluating the leadership of a unicorn startup, it’s essential to consider the background, expertise, and track record of the key executives. Do they have a proven history of building and scaling successful companies, or are they relatively new to the entrepreneurial landscape? Do they possess the necessary industry knowledge, technical skills, and strategic acumen to navigate the challenges of a high-growth startup?

Beyond the individual qualifications of the leaders, it’s also crucial to assess the dynamics and cohesion of the management team as a whole. Are the roles and responsibilities clearly defined, with each team member contributing their unique strengths and expertise? Is there a shared vision and alignment around the company’s strategic direction, or are there signs of internal conflicts and power struggles?

The company’s culture and the ability to attract and retain top talent can also be indicative of the leadership’s effectiveness. A positive, collaborative, and innovative work environment can foster employee engagement, loyalty, and productivity, all of which contribute to the startup’s long-term success. Conversely, a dysfunctional or toxic culture can lead to high turnover, loss of institutional knowledge, and a weakening of the company’s competitive edge.

Understanding the risks and challenges associated with investing in unicorn startups

While the allure of unicorn startups is undeniable, it’s essential to recognize the inherent risks and challenges associated with investing in these high-growth companies. Navigating the complex and often opaque world of unicorn startups requires a keen understanding of the potential pitfalls and a willingness to conduct thorough due diligence.

One of the primary risks associated with unicorn startups is the potential for overvaluation. As these companies attract significant investor attention and funding, their valuations can become detached from the underlying fundamentals of the business. This can lead to a situation where the startup’s true worth is not accurately reflected in its valuation, making it a risky investment proposition.

Additionally, unicorn startups often operate in highly competitive and rapidly evolving markets, where the landscape can shift quickly. Disruptions from new technologies, changes in consumer preferences, or the entry of well-established players can quickly erode a unicorn’s competitive advantage and lead to a decline in its valuation. Investors must be attuned to these market dynamics and be prepared to adapt their strategies accordingly.

Another challenge with investing in unicorn startups is the lack of transparency and access to information. Many of these companies operate in private markets, making it difficult for outside investors to obtain detailed financial data, competitive intelligence, and other crucial information necessary for informed decision-making. This information asymmetry can increase the risk of making uninformed investment decisions.

Furthermore, the path to an initial public offering (IPO) or other liquidity event for unicorn startups can be long and uncertain. Delays in going public or unexpected setbacks can prolong the investment timeline, leaving investors in limbo and potentially exposing them to additional risks. Investors must be prepared to hold their positions for an extended period and have a clear understanding of the startup’s roadmap to liquidity.

Strategies for evaluating the true value of a unicorn startup before it goes public

Given the complexities and risks associated with investing in unicorn startups, it’s crucial for investors and entrepreneurs to develop a systematic approach to evaluating the true value of these high-growth companies before they go public. By leveraging a combination of quantitative and qualitative analysis, investors can make more informed decisions and mitigate the potential for overpaying or investing in a company with questionable long-term prospects.

One key strategy is to conduct a comprehensive financial analysis of the unicorn startup, examining its revenue streams, cost structure, profitability, and cash flow. This involves delving into the startup’s financial statements, understanding the drivers of its growth, and assessing the sustainability of its business model. Additionally, investors should consider the startup’s ability to scale efficiently and its potential to generate positive cash flow in the long run.

Alongside the financial analysis, it’s essential to evaluate the startup’s market potential, competitive landscape, and growth trajectory. This includes understanding the size and growth rate of the addressable market, the startup’s market share, and its competitive advantages. Investors should also assess the potential for disruptive technologies or new entrants that could threaten the unicorn’s position.

Furthermore, the quality and experience of the leadership team and the overall company culture are crucial factors to consider. Investors should examine the backgrounds and track records of the key executives, as well as the team’s ability to work together effectively and execute on the company’s strategic vision. Additionally, the startup’s ability to attract and retain top talent can be a strong indicator of its long-term potential.

Finally, investors should be mindful of the potential risks and challenges associated with investing in unicorn startups, such as overvaluation, market volatility, and lack of transparency. By developing a comprehensive understanding of these factors, investors can make more informed decisions and better navigate the complex and often opaque world of unicorn startups.

Conclusion: Making informed investment decisions in the world of unicorn startups

In the ever-evolving landscape of entrepreneurship, unicorn startups have captured the imagination of investors and entrepreneurs alike. These billion-dollar companies promise the potential for astronomical returns, but it’s essential to look beyond the hype and assess their true value before making any investment decisions.

By delving into the key factors that determine the worth of a unicorn startup, such as its business model, market potential, financial health, leadership, and associated risks, investors and entrepreneurs can make more informed decisions. This comprehensive evaluation process can help them identify the true gems among the unicorns, separating the companies with genuine long-term potential from those riding the wave of inflated valuations.

As the unicorn phenomenon continues to evolve, it’s crucial for market participants to stay informed, conduct thorough due diligence, and make investment decisions based on a deep understanding of the underlying fundamentals. By doing so, they can navigate the complex and often opaque world of unicorn startups with confidence, positioning themselves for sustainable success in the ever-changing landscape of entrepreneurship.