In today’s financial landscape, understanding the concepts of leverage and liquidity is essential for managing personal debt and savings effectively. Leveraging is a powerful tool that allows individuals to multiply their investment returns by borrowing money to invest. On the other hand, liquidity refers to the availability of cash or assets that can be quickly converted into cash without incurring significant losses. Balancing the use of leverage and maintaining sufficient liquidity is crucial for individuals who aim to optimize their financial well-being.

In this article, we explore the parallels between corporate financial strategies and personal finance management, providing valuable lessons that can be applied to everyday financial decision-making. By examining how businesses utilize leverage and liquidity to maximize profits and mitigate risks, we can gain insights into managing personal debts, investments, and savings more intelligently.

Whether you are a seasoned investor or just starting your financial journey, understanding the principles of leverage and liquidity is the foundation for making informed decisions. Join us as we dive into the world of corporate finance and discover how these concepts translate into actionable strategies for personal financial success.

Understanding Leverage and Liquidity

Leverage is a financial strategy that involves using borrowed funds to amplify potential returns on an investment. In the corporate world, companies often leverage debt to finance growth, acquire assets, or increase operational capacity. This method can significantly enhance profitability when investments perform well. However, it carries inherent risks, especially in times of financial uncertainty or economic downturns.

On the other hand, liquidity is all about having immediate access to cash or easily liquidated assets. Companies must manage their liquidity carefully to ensure they can meet short-term obligations, such as payroll or supplier payments. A lack of liquidity can lead to severe financial distress, even if a company is profitable on paper. Understanding the balance between these two concepts is crucial for businesses and individuals alike.

For individuals, leverage can manifest in the form of loans, such as mortgages or personal loans intended for investments. While this strategy can lead to substantial gains, it can also result in significant losses if investments do not perform as expected. Therefore, understanding how to utilize leverage responsibly is critical for personal finance management. Similarly, maintaining liquidity ensures that individuals have the means to cover unexpected expenses or take advantage of investment opportunities without being forced to sell assets at a loss.

The Importance of Managing Personal Debt and Savings

Effective management of personal debt and savings is vital for financial stability and long-term wealth accumulation. High levels of debt can lead to financial stress, limiting an individual’s ability to save for emergencies or invest in future opportunities. Thus, understanding the dynamics of debt management is essential in today’s economic environment.

Savings, on the other hand, provide a financial cushion. They allow individuals to handle unexpected expenses without resorting to high-interest debt. A healthy savings account can also serve as a source of funds for investments, enabling individuals to leverage their financial position strategically. The interplay between debt and savings is crucial; maintaining a balance can lead to significant improvements in one’s overall financial health.

Moreover, the importance of saving cannot be overstated. It builds financial security and confidence, giving individuals the freedom to make choices without the looming pressure of debt. By developing a robust savings plan, individuals can create a financial buffer that allows them to take calculated risks with leverage while ensuring they have the liquidity needed for day-to-day expenses. Understanding these principles fosters better financial decision-making, leading to a more secure financial future.

Corporate Strategies for Managing Debt and Liquidity

Corporations often face complex financial landscapes that require careful management of debt and liquidity. Businesses deploy various strategies to strike a balance between leveraging their capital for growth while ensuring they can meet their short-term obligations. One common approach is the use of debt instruments such as bonds or loans to finance expansion while keeping a close eye on interest rates and repayment schedules.

Another strategy involves maintaining a strong liquidity position through cash reserves or liquid assets. Companies often set aside a portion of their profits to ensure they have sufficient funds available for operational needs or unforeseen challenges. By doing so, they can avoid the pitfalls of liquidity crises, which can jeopardize their overall financial health. Additionally, corporations often conduct thorough cash flow forecasting to predict their liquidity needs accurately. This practice is essential for understanding future obligations and ensuring they have the resources to meet them.

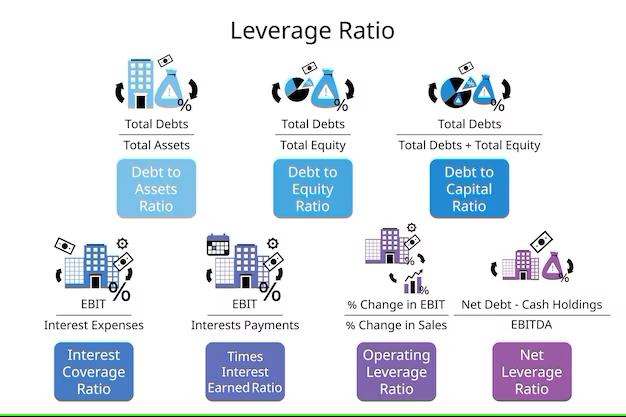

Furthermore, businesses also manage their debt-to-equity ratios carefully. A balanced ratio indicates that a company is not overly reliant on debt for financing, thus reducing financial risk. This approach enables corporations to leverage their capital effectively while maintaining a cushion against potential downturns. By applying these strategies, businesses can navigate the complexities of the financial landscape, making informed decisions that lead to sustainable growth.

Applying Corporate Lessons to Personal Finance

The lessons learned from corporate financial strategies can be invaluable for personal finance management. Individuals can adopt similar principles to manage their debt and savings effectively. For instance, just as corporations evaluate their debt levels, individuals should assess their debt-to-income ratio to ensure they are not over-leveraged. This assessment can provide a clearer picture of financial health and help set realistic debt repayment goals.

Additionally, individuals can benefit from maintaining an emergency fund, much like businesses keep cash reserves. This fund acts as a safety net, covering unexpected expenses and preventing individuals from relying on high-interest debt. Establishing a dedicated savings account for emergencies can also help individuals stay disciplined and avoid depleting their savings for discretionary spending.

Another vital lesson is the importance of cash flow management. Just as businesses forecast their cash flow needs, individuals should track their income and expenses to ensure they remain solvent. Creating a monthly budget can provide insights into spending habits and help identify areas for potential savings. By understanding where money is going, individuals can make informed decisions, allocating funds responsibly and avoiding unnecessary debt.

Developing a Personal Debt Management Plan

Creating a personal debt management plan is an essential step in taking control of finances. The first step is to assess the total amount of debt, including credit cards, personal loans, and any other liabilities. By listing debts, individuals can gain a clear understanding of their financial obligations and prioritize which debts to focus on first.

Once the total debt is assessed, individuals should explore various debt repayment strategies. One effective method is the snowball approach, where debts are paid off from smallest to largest. This strategy provides quick wins and can motivate individuals to stay committed to their repayment goals. Another method is the avalanche approach, where individuals focus on paying off high-interest debts first, ultimately saving money on interest over time.

In addition to repayment strategies, individuals should consider consolidating their debts if feasible. This can involve taking out a single loan to pay off multiple debts, often resulting in lower interest rates and simplified payments. However, individuals should exercise caution and ensure they understand the terms of any new loans. By developing a comprehensive debt management plan, individuals can reduce their debt burden and work towards achieving financial freedom.

Tips for Maximizing Savings and Minimizing Debt

Maximizing savings while minimizing debt is a fundamental goal for many individuals. To achieve this, it is essential to adopt smart financial habits. One effective tip is to automate savings. Setting up automatic transfers from checking accounts to savings accounts ensures that individuals prioritize saving before spending. This method creates a consistent saving routine that can lead to significant financial progress over time.

Another tip is to review and adjust spending habits regularly. By identifying areas where spending can be reduced, individuals can free up additional funds for savings. This might involve cutting discretionary expenses, such as dining out or subscription services, allowing for more significant contributions to savings or debt repayment. Keeping a spending journal can help track expenses and highlight patterns that may be adjusted.

Finally, it is crucial to take advantage of employer-sponsored retirement accounts, such as 401(k) plans. Many employers offer matching contributions, which can significantly boost savings. By contributing enough to receive the full match, individuals effectively increase their savings without additional effort. Investing in retirement accounts early can lead to substantial long-term growth, benefiting from compounding interest over time.

The Role of Budgeting in Managing Personal Finances

Budgeting is a cornerstone of effective personal finance management. It serves as a roadmap for individuals to track their income, expenses, and savings goals. Creating a budget involves assessing monthly income sources and categorizing expenses into fixed and variable costs. Fixed costs, such as rent or mortgage payments, remain constant, while variable costs fluctuate.

By establishing a budget, individuals can identify areas where they can cut back on spending and redirect those funds towards savings or debt repayment. Regularly reviewing the budget allows for adjustments based on changing financial circumstances, ensuring that individuals remain on track to meet their financial goals. Digital budgeting tools or apps can simplify this process, making it easier to monitor expenses in real time.

Moreover, budgeting promotes financial discipline. It encourages individuals to live within their means and avoid impulsive spending. By having a clear understanding of their financial situation, individuals can make informed decisions about when to leverage their resources and when to maintain liquidity. Ultimately, budgeting empowers individuals to take control of their finances and work towards long-term financial stability.

Tools and Resources for Tracking and Managing Personal Finances

In the digital age, numerous tools and resources are available to help individuals track and manage their personal finances effectively. Budgeting apps, such as Mint or YNAB (You Need A Budget), provide user-friendly platforms for monitoring income, expenses, and savings goals. These apps often come equipped with features that allow users to set budgets, track spending, and receive alerts when nearing their limits.

Additionally, financial planning software can assist individuals in creating detailed financial plans that encompass savings, investments, and retirement goals. Programs like Personal Capital offer tools for tracking net worth and investment performance, providing a comprehensive overview of one’s financial health.

For those seeking a more tailored approach, consulting with a financial advisor can be invaluable. Financial professionals can provide personalized insights and strategies based on individual circumstances, helping to create effective debt management and savings plans. Whether through digital tools or professional guidance, utilizing available resources can significantly enhance financial management and lead to more informed decision-making.

Seeking Professional Help for Debt Management and Financial Planning

While many individuals can manage their finances independently, seeking professional help can provide additional support and expertise. Financial advisors can assist with crafting personalized financial plans that align with one’s goals, whether that be reducing debt, increasing savings, or planning for retirement. They can offer valuable insights into investment strategies, helping individuals navigate the complexities of the financial markets.

Debt management specialists can also provide assistance for those struggling with overwhelming debt. These professionals can help individuals develop realistic repayment plans, negotiate with creditors, and explore options for debt consolidation or settlement. Their expertise can significantly alleviate the stress of managing debt and pave the way for a more secure financial future.

Moreover, seeking professional help can provide accountability. Regular check-ins with a financial advisor can motivate individuals to stay on track with their financial goals. Whether dealing with debt or planning for long-term savings, having an expert’s guidance can lead to more informed choices and ultimately foster greater financial well-being.

Conclusion: Taking Control of Your Financial Future

Understanding the concepts of leverage and liquidity is essential for effective personal finance management. By learning from corporate strategies, individuals can develop a more nuanced approach to managing their debts and savings. Implementing lessons from the corporate world, such as assessing debt levels, maintaining liquidity, and utilizing budgeting tools, can lead to more informed financial decisions.

Building a personal debt management plan, maximizing savings, and seeking professional help when needed can empower individuals to take control of their financial futures. Ultimately, the journey towards financial well-being requires discipline, planning, and the willingness to learn. By embracing these principles, individuals can navigate the complexities of personal finance and work towards achieving their financial goals.

In a world where financial uncertainty is common, understanding the balance between leverage and liquidity can make all the difference. By applying corporate financial strategies to personal finance, individuals can build a solid foundation for their financial well-being, ensuring that they are prepared for whatever the future holds.